In brief:

- Higher energy prices and interest rates will cause growth to slow across most of Europe, the UK and the US, with a number of countries falling into recession

- The energy shock will affect countries and sectors differently with some hit quite hard and some continuing to perform well

- As during the pandemic, investors that can ignore public market volatility have strong bottom-up analytical capabilities and medium-to-long term investment horizons should be able to find opportunity and outperform in this environment, in our view

There have been huge economic and political changes since my last economic update video. The good news is the world has become much better at managing the COVID pandemic, with most developed economies now fully reopened, and supply chain bottlenecks starting to unwind. The bad news of course, is geopolitics has become even more unstable with major negative consequences for the global economy.

The most significant development for global markets is the ongoing invasion of Ukraine by Russia. While the human toll of the invasion has been and continues to be devastating, the economic impact has also been huge.

It seems like a lifetime ago, but just one year ago, market expectations were for the Federal Reserve (Fed) to raise rates 25 basis points to half a percent this year, the Bank of England to around 1% and the European Central Bank (ECB) to keep its benchmark rate in negative territory for the foreseeable future. Fast forward to where we are today, the expectation now priced into swap markets is for the Fed funds rate to peak at nearly 5% in March next year, for the Bank of England to raise its target rate to a peak of 5.5% and the ECB to 3%.

Implications for economies and markets – cannot take a broad-brush approach

So how did we get here?What are the implications for economies and markets over the next 12 to 18 months?

The main transmission mechanism of the war to the global economy has been through commodity prices, particularly natural gas prices and to a lesser extent oil and agricultural prices. Natural gas prices in Europe and the UK are over 10 times 2019 levels and, in the US, nearly four times 2019 levels.

The sharp rise in natural gas prices with a particularly large spike over the summer has helped drive inflation higher, adding to the upward push already being exerted by tight labour markets, strong property markets and supply chain bottlenecks. This caused major developed markets central banks to accelerate interest rate hikes and ratchet up their hawkish rhetoric, driving government bond yields sharply higher and risk assets lower.

Looking forward over the coming few quarters we think the lagged impact of higher energy prices, higher mortgage and other interest rates will hit disposable income and cause private consumption and investment to slow across most of Europe, the UK and the US.

There are important offsets that should help cushion economies during this more difficult period. Despite these offsets, it is likely that most developed countries including the US will face recessions in the coming quarters.

However, it’s important to emphasise that there will likely be very wide variations in growth between countries over the coming year. Similar to what we saw during the COVID pandemic, I don’t think one can take a broad-brush approach to investing in this environment.

Each country’s economic makeup, their different exposures to energy prices and the effectiveness of their policy responses, will all play a role in determining their performance.

Outlook for European countries – performance will vary widely

While Germany and Italy’s large exposures to energy intensive industry and auto production are likely to cause their growth rates to slow quite sharply, less fossil fuel dependent countries in the Nordics are likely to see limited impact.

France and Spain will also likely be less affected with more diverse energy sources and a higher proportion of tourism and other services.

The UK on the other hand is likely to see a particularly hard hit to domestic demand in the near term, as self-inflicted policy mistakes by Prime Minister Liz Truss’ UK Government pushed bond yields to unnecessarily high levels and forced the central bank to intervene to support the gilt market. However, the situation could be reversed quite quickly if the post-Truss government restores its fiscal credibility.

Sector view – as during pandemic, some sectors will hold up better than others

Critically and in our view, even more important than country differentiation is the very wide performance dispersion we’re likely to see at a sector level. This is exactly what we saw during the COVID pandemic and one of the reasons many companies performed so strongly through the period.

Some sectors are likely to be hit quite hard in the coming quarters. These sectors include energy and supply chain intensive industries such as chemicals, cement, basic materials, as well as aviation, autos and parts of the consumer discretionary sector.

However, is not all bad news. We think other sectors such as health care and biotech, technology and digital business and financial services should see much more limited impact and some sectors such as green infrastructure, sustainable transport green transition, LNG and pipeline services will likely see a sustained structural boost to demand.

In addition, as long as we don’t see another sharp increase in energy prices, inflation is likely at or near peak in most countries in our view. High frequency indicators such as freight prices and purchasing manager surveys indicate supply chain bottlenecks are easing.

Inflation and rates – more pain in near term, but substantial improvements in 2H 2023

While employment markets remain tight. There are signs wage growth has peaked in the US in the UK, and in both the US and UK job openings have started to fall, pointing to a moderation of wage costs in 2023. Property markets are also cooling with rent growth now falling in the US.

Unfortunately, there can be long lags before high frequency data feed into consumer price indices (CPIs). Therefore, the Fed, the ECB and the Bank of England will likely continue to tighten into early next year.

However, falling inflation bodes well for the latter part of 2023 when on our base case, inflation should be falling quite quickly, and central banks will be in a position to stop tightening and potentially cut rates if needed.

Banking crisis unlikely

There are also a number of structural supports that should moderate the depths of the slowdown. Banks are in far stronger shape than they were back in 2008, before the global financial crisis. Balance sheets are strong, tier one capital has more than doubled and banks are regularly stress tested by regulators.

While banks may pull back on lending, the risk of a 2008-style financial crisis is quite low in our view.

Private company balance sheets strong in aggregate

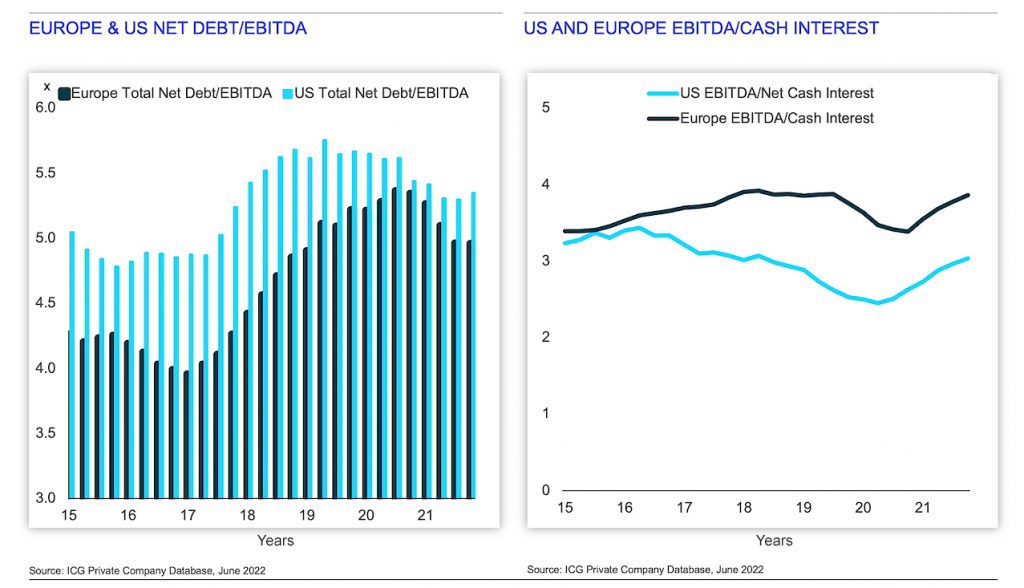

Corporates also enter this more difficult economic environment in strong shape. As many of you know at ICG, we have built a large database of private company fundamentals that allows us to track the health of private companies across countries and sectors in Europe and in the US. The database has information on nearly 1,500 private companies in over 14 years of tracking data.

As you can see in this chart, fundamentals as measured by leverage and interest coverage were healthy coming into 2022, with strong EBITDA growth pushing down leverage levels and combined with low interest rates pushing up interest coverage.

Preliminary data for the first half of 2022 has shown a continuation of these trends with both leverage and interest coverage holding it comfortable levels. While key metrics at an aggregate level are very likely to weaken in the coming quarters as growth slows and rates rise, they are coming from a strong starting point.

Rating agency data corroborates this with high yield default rates in June this year, lower than they were pre-COVID. Households also entered this period in a strong position with substantial savings built up during the COVID lockdown periods available to help smooth consumption and debt service ratios at their lowest levels on record.

Government support will blunt energy shock impact

Finally, and perhaps most critically for Europe and the UK, governments are now acting decisively to support households and companies through the energy shock. With full details of the support programmes still being worked out, they currently range in size from 2% to nearly 8% of GDP, with Germany just recently announcing a €200bn support programme.

In addition to European country level programmes, the EU is also working on region wide fiscal support programmes and tapping into its €800bn Next Generation Recovery Fund.

While fiscal support may not prevent near-term slowdowns as we saw during the pandemic, if designed and implemented well they can substantially blunt the impact of an external shock.

Asia growth to outperform

Although Asia will not be immune to the slowdown in major Western economies, we think growth will continue to outperform the US and Europe. While consumer durable-exporting companies are likely to face headwinds, services and domestic demand-focused companies should continue to do well in our view.

As COVID vaccination rates rise and stocks of COVID treatments are built, countries should continue to open up, allowing pent-up domestic demand and travel to pick up given the size of its economy and its role in the global supply chain.

A big question is whether China will start to ease it zero COVID policy in the coming quarters. In our view, it likely will as vaccination rates of the elderly rise, stocks of COVID treatments increase and domestic economic and political imperatives allow for a gradual easing of policy in 2023.

As we’ve seen in Europe in the US an easing of COVID restrictions has the potential to unleash a very powerful wave of private consumption. If correct, this would likely lead to upside growth surprises across the region later in 2023, as China demand rises and outward tourism flows resume.

Reasons for optimism

While we think the global economy is going into a difficult period and a number of companies will face much more challenging operating conditions over the coming quarters, we think there are also reasons for optimism.

The impact of the energy shock will vary widely by country and sector. As during the pandemic, company performance will also vary widely depending on their sector and country exposures. While the coming winter will likely be difficult for households and companies, by the latter part of 2023 we expect inflation, rates and growth will be improving.

Investors that can ignore public market volatility have strong bottom-up analytical capabilities and medium-to-long term investment horizons should be able to find opportunity and outperform in this environment, in our view.

Nick’s video was recorded and broadcast to ICG clients in the second week of October. The article above has been updated in places.

Go deeper

- US and Europe Private Company Trends [June 2022]

- When will China’s zero-COVID policy end? [June 2022]

- What we do

Back

Back