In this 10th bi-annual edition of the ICG Private Company Trends report, we provide an in-depth view of the key fundamental trends we are seeing across this historically opaque segment of the market and assess the outlook for the rest of 2023 and into 2024.

Email [email protected] to request a copy of the full report.

Key findings include:

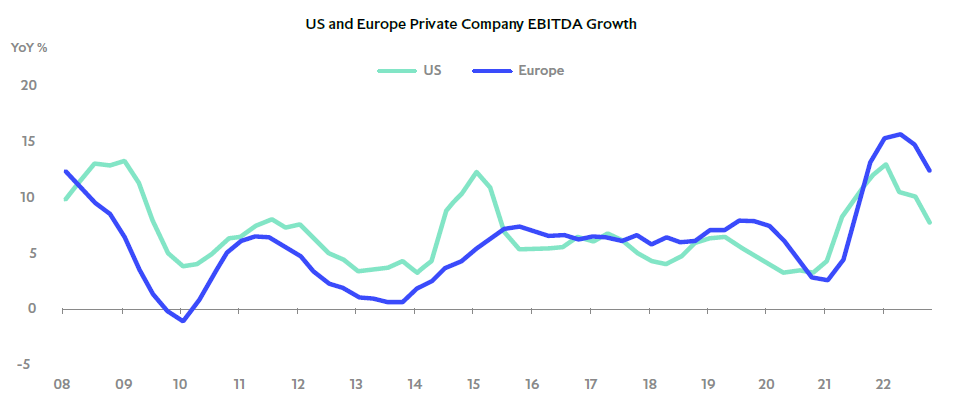

- Private companies tracked by the ICG Private Company Database performed strongly in 2022, with EBITDA in the US and Europe rising sharply as the tailwinds from economic re-opening and large-scale fiscal and monetary support in 2021 more than offset the headwinds of rising inflation, monetary tightening and geopolitical volatility.

- In the second half of the year, however, there were signs that top-line growth was peaking and that margins were coming under pressure as companies had a harder time fully passing on higher input costs – particularly in the US.

- We think these trends will likely continue through the rest of 2023 and into 2024, with top-line growth slowing as the lagged impact of central bank tightening and a sating of pent-up demand built-up during the Covid pandemic weighs on consumers’ spending and reduces their tolerance for further goods and services price hikes.

- However, as was the case during the Covid-19 pandemic, we think performance will vary widely by country, sector and sub-sector, with less cyclical sectors such as healthcare, technology, business and financial services, infrastructure and education holding up relatively well.

- On the other hand, cyclical sectors such as industrials and materials, and companies dependent on consumer discretionary spending and parts of the real estate sector may see intensified pressure in 2023.

- While fundamentals at an aggregate level are likely to deteriorate as growth slows and input costs become more difficult to pass on, we think limited exposure to the most vulnerable sectors, comfortable starting leverage and interest coverage, large equity cushions and large stores of available dry powder, should hold most private companies in good stead.

EBITDA growth slowing, but still healthy

Back

Back