In this 11th bi-annual edition of the ICG Private Company Trends report, we provide an in-depth view of the key fundamental trends we are seeing across this historically opaque segment of the market and assess the outlook for 2024.

Email [email protected] to request a copy of the IGC client-only report.

Summary of key trends

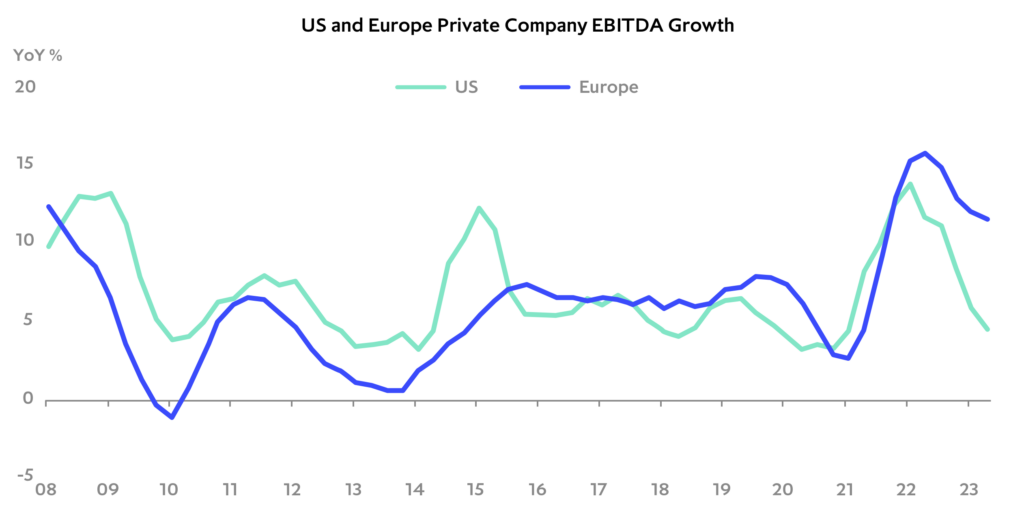

- Private company revenue and EBITDA growth started to normalise in Europe and the US in the first half of 2023, slowing from the exceptionally strong growth rates of 2022.

- Europe median private company revenue and EBITDA in Q2 2023 slowed to 16% and 12% respectively while US revenue growth slowed to 12% and EBITDA slowed to its 2018-19 average of 5% on tighter margins.

- Performance at a sector level continued to diverge, with commercial and professional services, logistics, infrastructure and key subsectors of technology and healthcare performing strongly while more cyclical sectors such as machinery, chemicals, materials and parts of the consumer discretionary sector saw weaker growth.

- Debt metrics remained healthy in H1 2023, with Europe’s median interest coverage holding at 3.5 times cash interest, more than 50% above 2009 levels. In the US, median interest coverage fell on higher rates and weaker EBITDA growth, but at 2.5 times cash interest, remained at comfortable levels.

- Equity cushions remained substantial, with the equity contribution to enterprise value in the US rising to an all-time high of 53% in Q3 2023, providing substantial protection to debt holders.

Private company EBITDA growth is normalising

Report author Nick Brooks, commented:

Despite a difficult economic and geopolitical environment and sharply higher interest rates, private companies tracked by ICG’s Private Company Database performed well through the first half of 2023 and company level and anecdotal evidence indicates performance held up well in the second half of the year.